hawaii tax id number cost

For example if you have incorporated your LLC you may need a new Hawaii tax ID number. Due to the confidentiality of Social Security numbers DOTAX issues a specific tax account number for each taxpayer that does not have a Federal Identification number.

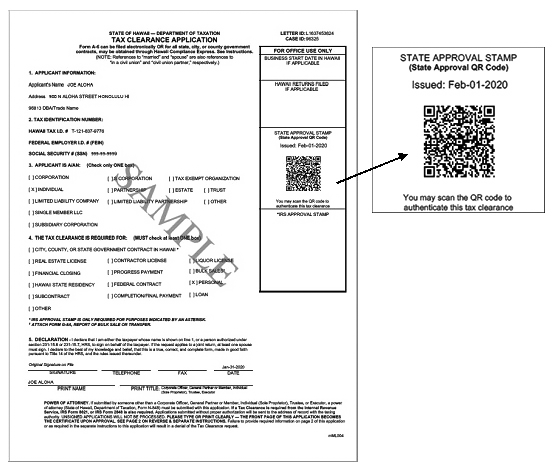

Tax Clearance Certificates Department Of Taxation

Wholesaling retailing farming services construction contracting rental of personal or real property business interest income and royalties.

. You can start your business and get a tax ID in AIEA cost to start is about 10817 or could start with 106677 that depends on your budget. 13How do I apply for a HI Tax ID and tax licenses. EMPLOYMENT OPPORTUNITIES Thank you for your interest in working for the A Program.

You can get a tax ID in HONOLULU AIEA 96701 on this site. The new Hawaii Tax ID number format makes it easy to distinguish between customer ID and Hawaii Tax ID account numbers. However you will only pay income tax on your net income.

A Hawaii Federal Tax ID Number which is also known as an Employer ID Number EIN or Federal Tax Identification Number is a unique nine-digit ID assigned by the Internal Revenue Service for tax purposes for businesses as well as Non-Profit organizations Trusts and Estates. Anyone who receives income from conducting business activities in the State of Hawaii including but not limited to. Transient Accommodations Tax Certificate of Registration.

In August 2017 Hawaiis Department of Taxation began a modernization project which also included a change in the format of the Hawaii Tax ID numbers. In most cases if you are doing business in Hawaii then you must pay both GET and Hawaii income tax. Once youre done with the application you should receive your tax ID via email in an hour or less.

Therefore the last four-digits of the specific tax account number issued by DOTAX are used on the billing notices rather than the last four digits of your Social Security. And mail takes 4 weeks. Applying for an EIN with the IRS is free 0.

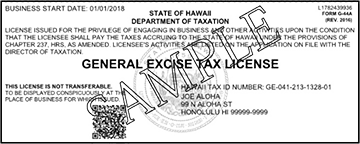

Once your application has been submitted our agents will begin on your behalf to file your application and obtain your Hawaii Tax ID. A Hawaii tax ID number for a business or a business Hawaii tax ID number is not free when you use our service to obtain it. How much does a General Excise Tax license cost in Hawaii.

Your net income is the profit remaining after you deduct allowable business expenses from your gross income. Additional fees may apply depending on which tax licenses you need. Hawaii Income Tax 10.

Online approval takes 15 minutes. So if you apply for a Hawaii state tax ID number with us whether it is a state Hawaii state tax ID number or you are applying for a Hawaii state tax ID number click here to select state first. Even though applying online is universally the best application method there are some other methods to choose from.

Apply for a Hawaii Tax ID by Phone Mail or Fax. How long does it take to get a Hawaii General Excise Tax license. Rental Motor Vehicle Tour Vehicle and Car-Sharing Vehicle Surcharge Tax RV Taxpayers will benefit from faster.

Instead we have the GET which is assessed on all business activities. To avoid inconveniencing taxpayers the Department will continue to process returns and payments received with old Hawaii Tax. Expect 3-5 business days to receive a Hawaii Tax Identification Number and General Excise Tax license when registering online or 3-4 weeks when applying by mail.

Hawaii Tax ID number prefixes also make it possible to know the associated tax type at a glance. DOE TAX CREDIT NUMBER. Then there is a Federal Tax ID Number a Business Tax Registration Number and a Social Security Number for your personal income tax.

If you do not know how to obtain it though it is. The Department of Taxation is moving to a new integrated tax system as part of the Tax System Modernization program. There is a fee for our services.

Hawaii does not have a sales tax. Apply for a Hawaii Tax ID Number. Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common transactions online with the Hawaiʻi Department of Taxation.

As of August 14 2017 this system supports the following business tax accounts. Do I also have to pay Hawaii income tax. There is a fee for our services.

Or if you have received a new charter from the Secretary of State your corporation will need a new ID. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use. Register online through the DOTAX website at hitaxhawaiigovor the HBE website at hbeehawaiigov.

A Hawaii tax id number can be one of two state tax ID numbers. The fee for a General Excise Tax License is a one-time cost of 20. Complete Form BB-1 State of Hawaii Basic Business Application and pay a one-time 20 registration fee.

Competing companies can take several days to deliver your new Tax ID Number and can cost hundreds of dollars. Obtain your Tax ID in Hawaii by selecting the appropriate entity or business type from the list below. Tax Announcement 2021-09 New REIT Reporting Requirement under Act 78 Session Laws of Hawaii 2021 This Tax Announcement provides guidance regarding the notification requirement for Real Estate Investment Trusts REITs under Act 78 Session Laws of Hawaii 2021 Act 78.

This ID number should not be associated with other types of tax accounts with the state of Hawaii such as income tax. The Hawaii Tax ID Application Guide is the answer to your EIN problems. You can learn more about this update here on the states website Hawaii.

A Hawaii state tax ID number for a business or a business Hawaii state tax ID number is not free when you use our service to obtain it. Act 78 applies to taxable years beginning after December 31 2021. A sellers permit also called a sales tax ID or a state employer Number ID for employee tax withholding.

LLC University will show you how to get an EIN Number Federal Tax ID Number for a Hawaii LLC. After your Tax ID is obtained it will be sent to you via e-mail and will be available for immediate use. So if you apply for a Hawaii tax ID number with us whether it is a state Hawaii tax ID number or you are applying for a Hawaii tax ID number click here to select state first.

And if your partnership ends and a different one is formed the. You may be a Corporation an Estate LLC or Partnership and know you need a Tax Identification Number in Hawaii. Tax Services Hawaiʻi Tax Online.

Apply for a Hawaii Tax ID Number. The city has about 41423 population though only about 14181 families in this area in HI. If your childs A Program is serviced by a private provider please inquire with the provider for their federal and state identification numbers.

Fax takes 4 business days. Hawaii Tax ID Number Changes. You can get an EIN for your Hawaii LLC online by fax or by mail.

Hack Your Taxes With Our Tax Season Webinar Consolidated Credit Credit Consolidation Tax Season Filing Taxes

Licensing Information Department Of Taxation

Register For A Sales Tax Permit In The State Of Virginia Business Solutions Virginia Sales Tax

County Surcharge On General Excise And Use Tax Department Of Taxation

Filing Hawaii State Tax Things To Know Credit Karma Tax

Moving To Puerto Rico Start Here Living In Puerto Rico Puerto Rico Caribbean Travel